Capesize

The Capesize market did get off to a positive start this week as rates were building strongly off improved sentiment. But as events in Europe took hold, the market abruptly changed course. The Capesize 5TC reached a high of $18,181 Wednesday before shedding 4,155 by week end to close at $14,026. Increased fuel prices are eating into voyage rate earnings while routes like the West Australia to China C5 closed the last day of the week down 1.505 to $8.80. On the ballaster Brazil to China C3 route, rates were also seen to soften to $21.695 by close of week. The Transpacific C10, wher the bulk of Capesize tonnage resides currently, came under heavy pressure settling down 6,088 to $11,154. This is contrast to the Trans-Atlantic C8 which saw only a slight easing down 1,125 to $16,325. The Capesize market - along with other shipping sectors - now find themselves in the unenviable situation of being cut off from several trade routes due to war risk as vessels are now being halted, turned around and send sailing in the opposite direction.

Panamax

The Panamax market began the week on a firm footing in both basins. The Atlantic saw a thinning tonnage list pitted against both a strong mineral demand in the North, alongside healthy grain demand ex NC South America and EC South America. This culminated in stronger numbers fixed. An 84,000dwt delivery Italy achieving $21,000 for a transatlantic round trip via NC South America is an indicative mark at that time. These fundamentals remained largely unchanged, until events unfolded in Ukraine on Thursday and put a freeze on this momentum in the Atlantic. As bids were withdrawn/FFA values eroded as the market took stock of potential consequences. Asia began slowly, but a stable cargo flow ex NoPac/Australia and Indonesia for the most part continued to support rates. An 81,000dwt delivery North China fixing at $25,250 for a NoPac round trip. There was a steady appetite for period all week, an 85,000dwt delivery Korea agreed to $28,750 for a one-year period.

Ultramax/Supramax

A story of two halves over the week. Whilst from the Asian arena positive movement was seen in most areas, the Atlantic was dominated by the situation unfolding in the Black Sea region. Period activity was seen, a 63,000dwt open West Africa fixing a short to medium period with redelivery Atlantic at around $28,000. The Atlantic was very fluid. A 63,000dwt fixing a scrap run from the Continent to Turkey at $17,000, whilst another 63,000dwt fixed a trip from Central Mediterranean to the Caribbean at $22,000. From Asia better levels were seen. A 53,000dwt open Singapore fixing via Indonesia redelivery China at $35,000. A 59,000dwt open Kalimantan area fixing a trip via Indonesia redelivery West Coast India at $35,000. Stronger levels from the north as well, a 63,000dwt open Busan fixing a trip to West Africa at $32,000 for first 70 days and thereafter $35,000. There was limited activity from the Indian Ocean, a 62,000dwt open Calabar fixing a trip via South Africa redelivery China at $34,000.

Handysize

With the developing situation in the Ukraine, brokers spoke of some uncertainty as to the effects at present. As an ongoing issue it would need to be monitored closely. It was noted by brokers that some Owners were now reluctant to call these regions and conwartime clauses were coming into effect. The US Gulf region continues to firm with a 38,000dwt fixing from Houston to Italy at $21,000. East Coast South America is a two-tier market with prompt tonnage softer with a 38,000dwt fixing and failing a trip from Recalada to the North Continent in the mid $20,000s. However, a 38,000dwt open in March was seen fixing Brazil to the Continent at $29,000. Asia remains firm with period activity high. A 34,000dwt fixing from Surabaya for 90 to 120 days with worldwide redelivery at $34,000 and a 28,000dwt open in the Arabian Gulf fixing for four to six months at $26,000

Clean

In the Middle East Gulf this week the TC1 has begun to show higher freight levels on the LR2s, which are currently marked at WS76.43 and on an upward trend. The LR1s have been active and TC5 55k Middle East Gulf / Japan with more enquiry has seen levels hop up and break the WS100 barrier to WS102.14. The MRs this week saw TC17 retested back up to WS200.42 (-WS3.75), with the round trip TCE at $10,249/day.

West of Suez, The LR2s, TC15 80k Mediterranean / Japan have had another flat week with little open enquiry and remain at the $1.85m mark for the moment.

The LR1s, TC16 60k Amsterdam / Offshore Lomé again droped through lack of activity and are currently around the WS100 mark. On the UK-Continent, MR freight levels have crumbled as the week has gone on. TC2 37k UK-Continent / US Atlantic Coast dropped 23.33 points to WS145, a round trip TCE of $4,695/day. TC19 37k Amsterdam to Lagos has, as usual, followed suit. It fell 25.71 points to WS149.29 (a round trip TCE of $6,803/day).

The Americas have seen another week of improvement of freight with both MR routes once again showing a consistently firming sentiment. TC14 38k US Gulf / UK-Continent is now WS 136.79 (+WS11.08) and TC18 38k from US Gulf / Brazil WS 189.29 (+7.86) a round trip TCE of $14,029/day.

The MR Atlantic basket TCE fell from $15,658/day to $14,618/day.The Baltic Handymax market jumped at the beginning of the week TC9 30k Baltic / UK-Continent is now WS232.86 (+22.86) for the moment. In the Mediterranean, Handymax rates have been edging upwards again all this week. TC6 30kt Skikda / Lavera is now up at WS262.5 (+WS9.06).

VLCC

An upturn all around for the VLCC this week. In Middle East markets, Rates for 280,000mt Middle East Gulf/USG (via Cape of Good Hope) came up to 19.5 level, while on the 270,000mt Middle East Gulf/China route rates climbed consistently all week to WS38.82 (which shows a round trip TCE of minus $5,800 per day). At the time of writing WS39 is reported on subjects a couple of times. In the Atlantic, the 260,000mt West Africa/China trip followed a similar pattern of freight level rise all week and presently sits at WS41.18 (a round-trip TCE of minus $2,504 per day). A widely reported VLCC fixture for USG/Korea at $4.95m looks to have led the 270,000mt US Gulf/China trip to be assessed at $775,000 - higher than a week ago, presently at $5.1875m (a round-trip TCE of minus $1,778 per day).

Suezmax

Rates had begun to increase gradually, spiking at the end of the week. TD20, 130,000mt Nigeria/UKC ended up at the WS75 level (a round-trip TCE of approx. $5,800 per day) and TD6 135,000mt Black Sea/Augusta route jumped to WS97.78 (+27.34) (a round-trip TCE of $16,630 per day). In the Middle East Gulf TD23, 140,000mt Basrah/West Mediterranean came up from WS29.69 to WS35.

Aframax

The 80,000mt Ceyhan/Mediterranean rose to WS125.31 (+21.62) (a round-trip TCE of $15,514 per day. In Northern Europe the rate for 80,000mt Hound Point/UKC is 36.56 points higher than last week at WS133.44 (a round-trip TCE of $21,710per day). The 100,000mt Baltic/UKC market had the greatest hike of the week of +WS207.5 to WS290 (a round-trip TCE of $121,741 per day).

On the other side of the Atlantic, the market looks to have plateaued this week 70,000mt EC Mexico/US Gulf was steadfast around the WS160 mark (+/- 2.5 points) a round-trip TCE of around $24,000 per day. On TD9 the 70,000mt Caribbean/US Gulf route, dipped midweek to WS150 but has now returned to around the WS155 mark returning a round-trip TCE of $17,250 per day. For the transatlantic route, the rate for 70,000mt US Gulf/UK Continent havin started the week fixing in the mid WS130s paused at last done levels ($12,600 per day round-tip TCE, which becomes a considerably improved figure basis one-way economics).

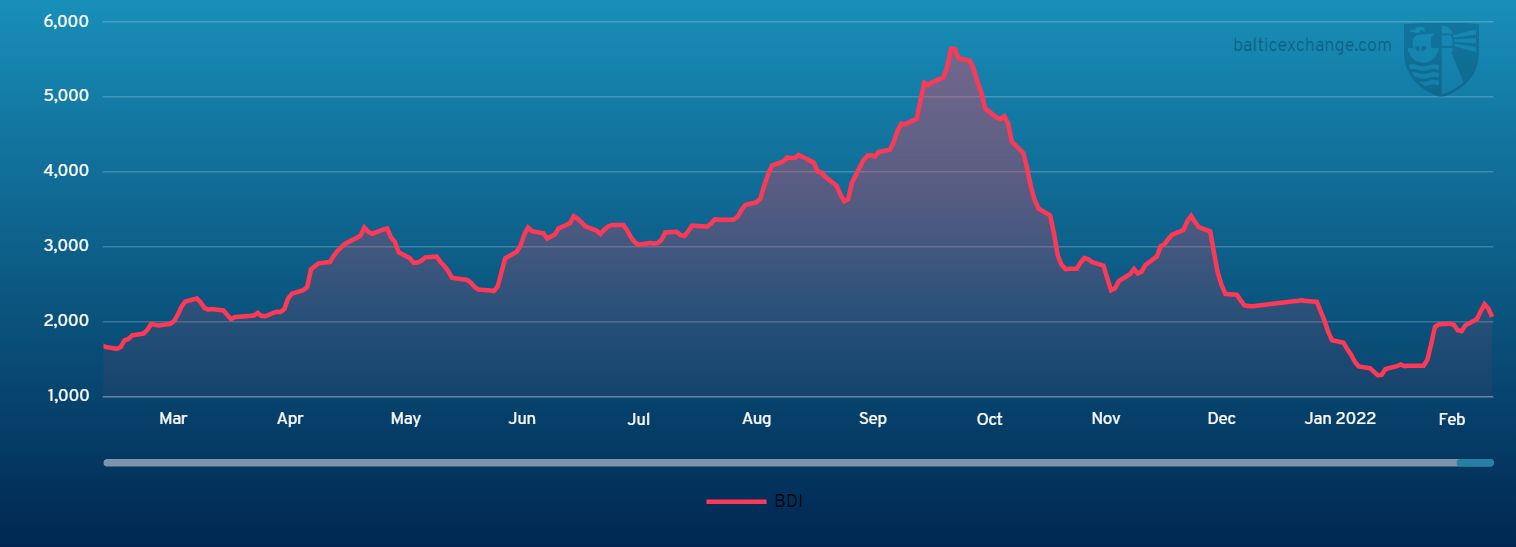

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

Chart shows Baltic Dry Index (BDI) during Feb.25, 2021 to Feb.25, 2022

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.